Kicking off with High-Value Property Insurance: Do You Really Need It?, this opening paragraph is designed to captivate and engage the readers, providing a comprehensive overview of the topic.

In the following paragraphs, we will delve into the specifics of high-value property insurance, covering its benefits, limitations, cost factors, specialized features, and more.

Overview of High-Value Property Insurance

High-value property insurance is a specialized type of coverage designed to protect properties with a higher than average value. This type of insurance is essential for property owners who own homes, estates, or valuables that exceed the coverage limits of standard homeowners insurance policies.

Types of Properties Requiring High-Value Insurance

- Luxury homes: Properties with high-end features, custom designs, and expensive materials often require high-value insurance to adequately protect their value.

- Historic properties: Buildings with historical significance or unique architectural elements may need specialized coverage to ensure proper restoration in case of damage.

- Fine art collections: Valuable art pieces, antiques, or collectibles should be insured under a high-value policy to cover their full worth in case of theft, damage, or loss.

- High-end jewelry: Expensive jewelry items such as diamonds, watches, or designer pieces need additional coverage beyond standard policies to protect against loss or theft.

Importance of Adequate High-Value Property Insurance

Insuring high-value properties adequately is crucial to protect the substantial investment made in acquiring these assets. Standard homeowners insurance policies may not provide sufficient coverage for expensive properties, leaving owners vulnerable to financial losses in case of unforeseen events.

Coverage Benefits and Limitations

When it comes to high-value property insurance, there are specific benefits and limitations that set it apart from standard homeowners' insurance. Understanding these differences can help you determine if this type of insurance is necessary for your situation.

Coverage Benefits

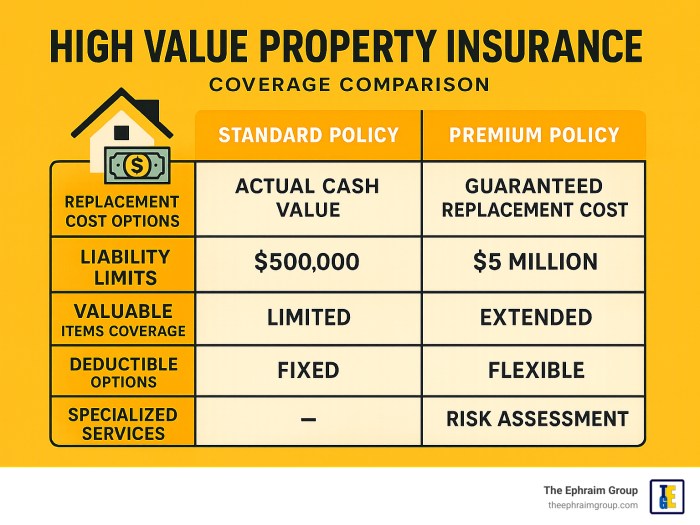

- Higher Coverage Limits: High-value property insurance typically offers higher coverage limits than standard homeowners' insurance. This ensures that your valuable assets are adequately protected in the event of a loss.

- Extended Coverage: High-value property insurance may provide coverage for additional risks that are not included in a standard policy, such as coverage for valuable art collections, jewelry, or antiques.

- Specialized Claims Handling: Insurers that offer high-value property insurance often have specialized teams to handle claims efficiently and effectively, providing personalized service tailored to your unique needs.

Limitations Compared to Standard Homeowners' Insurance

- Higher Premiums: High-value property insurance typically comes with higher premiums compared to standard homeowners' insurance due to the increased coverage limits and specialized coverage options.

- Stricter Requirements: Insurers may have stricter underwriting requirements for high-value property insurance, such as security systems, appraisals, and maintenance standards, to ensure the protection of valuable assets.

- Limited Availability: Not all insurance companies offer high-value property insurance, making it important to research and find a provider that specializes in this type of coverage.

Scenarios Where High-Value Property Insurance is Crucial

- High-Value Assets: If you own valuable art, jewelry, antiques, or collectibles that exceed the coverage limits of standard homeowners' insurance, high-value property insurance is essential to protect these assets.

- Unique Risks: If your property is at higher risk due to its location, such as being in a wildfire-prone area or a flood zone, high-value property insurance can provide the specialized coverage needed to mitigate these risks.

- Customized Coverage: For homeowners who require customized coverage options tailored to their specific needs, such as coverage for home office equipment or high-end electronics, high-value property insurance offers the flexibility to create a policy that meets these requirements.

Factors Influencing High-Value Property Insurance Costs

When it comes to high-value property insurance, several factors come into play that can influence the cost of premiums. Understanding these factors is crucial for property owners looking to secure adequate coverage without breaking the bank.

Property Value

The value of your property is a significant factor that directly impacts the cost of insurance

Location

The location of your property also plays a key role in determining insurance costs. Properties located in areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, may face higher premiums due to the increased risk of damage. Additionally, properties in high-crime areas may also incur higher insurance costs.

Unique Features

Unique features of a property, such as a swimming pool, extensive landscaping, or custom-built structures, can impact insurance premiums. These features may increase the replacement cost of the property and pose additional risks, leading to higher insurance costs. Property owners should accurately disclose all unique features to ensure proper coverage.

Tips for Reducing Insurance Costs

- Implementing security measures, such as alarms and surveillance systems, can help lower insurance premiums by reducing the risk of theft or vandalism.

- Regular maintenance and upgrades to the property can demonstrate proactive risk management to insurance companies, potentially leading to lower premiums.

- Increasing deductibles can result in lower premiums, but property owners should ensure they can afford the out-of-pocket expenses in case of a claim.

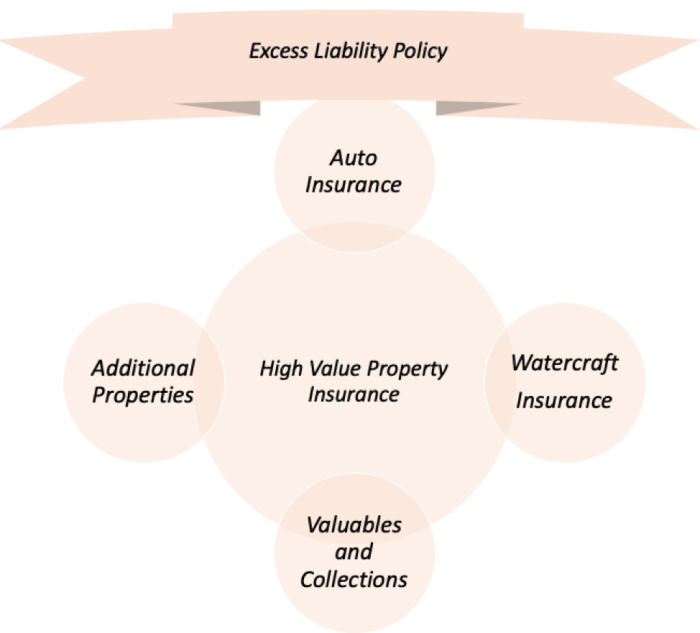

- Bundling high-value property insurance with other policies, such as auto or umbrella insurance, may qualify for discounts from insurance providers.

Specialized Features and Add-Ons

When it comes to high-value property insurance, there are various specialized features and add-ons that can enhance the coverage and cater to specific needs of property owners. These additional options provide extra protection and flexibility, ensuring that your valuable assets are adequately insured.

Extended Replacement Cost Coverage

One of the key specialized features offered by high-value property insurance policies is extended replacement cost coverage. This feature goes beyond the standard coverage limits to provide additional funds for rebuilding or repairing your property in case of a covered loss.

It ensures that you are not left underinsured in the event of a major disaster, such as a fire or natural calamity.

Cash Settlement Options

Another valuable add-on available with high-value property insurance is the option for cash settlement. This feature allows property owners to receive a lump sum payment for their covered losses instead of going through the process of repairing or replacing the damaged property.

Cash settlement options provide flexibility and quick access to funds, enabling property owners to make necessary repairs or replacements as they see fit.

Customized Coverage

It is important to note that high-value property insurance policies can be customized to meet the specific needs of individual properties. By adding on specialized features and tailor-made options, property owners can ensure that their insurance coverage aligns with the unique characteristics and risks associated with their valuable assets.

Customizing coverage helps in maximizing protection and minimizing gaps in insurance.

Last Word

To wrap up our discussion on High-Value Property Insurance: Do You Really Need It?, we have explored the various aspects of insuring high-value properties and why it is essential.

Q&A

What types of properties typically require high-value insurance coverage?

Properties such as luxury homes, historic estates, high-end condos, and valuable collections often require high-value property insurance to adequately protect their worth.

How can property owners potentially reduce insurance costs?

Property owners can potentially reduce insurance costs by installing security systems, maintaining the property well, bundling policies, and increasing deductibles.