Commercial Property Insurance: What It Covers and Why sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

When it comes to protecting business assets, commercial property insurance plays a crucial role. Understanding the coverage options and exclusions can make a significant difference in safeguarding your investments.

Overview of Commercial Property Insurance

Commercial property insurance provides coverage for physical assets owned by a business. This type of insurance helps protect businesses from financial losses due to damage or destruction of their property.

Types of Properties Covered

- Buildings: Including offices, warehouses, and retail stores.

- Equipment: Such as machinery, computers, and furniture.

- Inventory: Stock or goods stored on the premises.

- Landscaping and outdoor signs: Coverage for exterior property elements.

Importance of Commercial Property Insurance

Commercial property insurance is crucial for businesses as it helps safeguard their assets from unforeseen events like fires, theft, vandalism, or natural disasters. Without this insurance, a business could face significant financial losses that may be challenging to recover from.

By having commercial property insurance, businesses can have peace of mind knowing that their physical assets are protected.

Coverage Offered by Commercial Property Insurance

Commercial property insurance provides coverage for a wide range of risks and perils that businesses may face. This type of insurance is essential for protecting the physical assets of a business, including buildings, equipment, inventory, and more.

Standard Coverage Options

- Building Coverage: This includes protection for the physical structure of the building against perils such as fire, vandalism, and natural disasters.

- Business Personal Property Coverage: Covers the contents of the business premises, including inventory, equipment, and furniture, in case of damage or theft.

- Business Interruption Coverage: Provides financial support for lost income and ongoing expenses if the business is unable to operate due to a covered event.

- Liability Coverage: Protects the business from legal claims and lawsuits related to property damage or injuries that occur on the premises.

Events Covered by Commercial Property Insurance

- Fire: Damage caused by fire, whether accidental or intentional, is typically covered by commercial property insurance.

- Natural Disasters: Events such as hurricanes, tornadoes, earthquakes, and floods are usually covered, depending on the policy.

- Theft and Vandalism: Losses due to theft or vandalism of property are commonly included in commercial property insurance coverage.

Optional Coverages

- Flood Insurance: While some natural disasters are covered, flood damage is often excluded and requires a separate policy.

- Equipment Breakdown Coverage: Protection for essential equipment and machinery in case of mechanical breakdown or failure.

- Spoilage Insurance: Covers losses due to spoilage of perishable goods caused by equipment failure or power outages.

Exclusions in Commercial Property Insurance

When it comes to commercial property insurance, it is essential to understand what is not covered under the policy. Exclusions in commercial property insurance policies can vary depending on the insurance provider and the specific policy. These exclusions determine the situations or scenarios where the insurance company will not provide coverage.

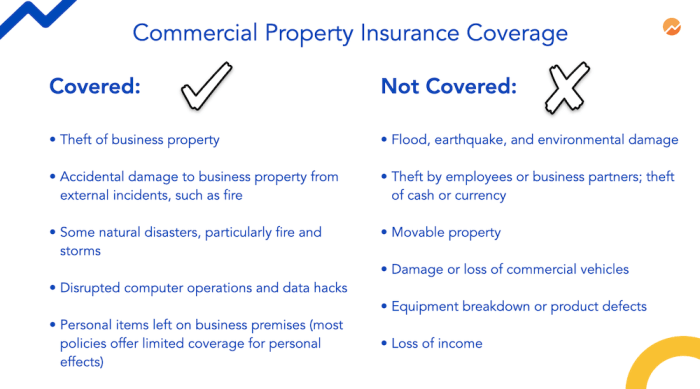

Common Exclusions in Commercial Property Insurance

While each policy may have its own specific exclusions, some common exclusions in commercial property insurance typically include:

- Damaged caused by floods, earthquakes, or other natural disasters

- Wear and tear or gradual deterioration of the property

- Acts of war or terrorism

- Neglect or intentional damage by the property owner

- Losses due to power outages or utility failures

Scenarios Not Covered by Commercial Property Insurance

Businesses should be aware that certain scenarios or situations are typically not covered by commercial property insurance. These may include:

- Losses due to employee dishonesty or fraud

- Cybersecurity breaches and data loss

- Business interruptions not directly related to physical property damage

How Businesses Can Mitigate Risks for Excluded Items

While some risks may be excluded from commercial property insurance coverage, businesses can take proactive steps to mitigate these risks. This may involve:

- Purchasing additional insurance policies to cover specific exclusions, such as cybersecurity insurance

- Implementing robust security measures to prevent employee dishonesty or fraud

- Developing a comprehensive business continuity plan to address potential interruptions

Importance of Business Interruption Coverage

Business interruption coverage is a vital component of commercial property insurance that helps businesses recover from unexpected events that disrupt their operations. This type of coverage is designed to provide financial support to businesses when they are unable to operate due to covered perils, such as natural disasters, fires, or other unforeseen events.

Examples of Situations Requiring Business Interruption Coverage

- A restaurant forced to close temporarily due to a kitchen fire, resulting in loss of revenue and ongoing expenses.

- A manufacturing facility damaged by a hurricane, leading to a halt in production and loss of income.

- A retail store flooded during a storm, causing extensive damage and a need to shut down for repairs.

How Business Interruption Coverage Helps Businesses Recover

Business interruption coverage can help businesses cover ongoing expenses, such as payroll, rent, and utilities, even when they are unable to generate revenue. This coverage can also provide funds for temporary relocation, extra expenses incurred to minimize the interruption, and loss of profits during the downtime.

By offering financial support during challenging times, business interruption coverage plays a crucial role in helping businesses bounce back and resume operations smoothly.

Factors Affecting Commercial Property Insurance Premiums

When it comes to commercial property insurance, several factors can influence the cost of premiums. Understanding these key factors is essential for businesses looking to secure the right coverage at a reasonable price.

Location of the Business

The location of a business plays a significant role in determining commercial property insurance premiums. Businesses located in high-crime areas or regions prone to natural disasters such as hurricanes or floods are considered higher risk and may face higher premiums.

Size of the Business Property

The size of the business property also impacts insurance premiums. Larger properties typically have higher replacement costs, which can lead to higher premiums. Additionally, the age and condition of the property can affect premiums as well.

Type of Business and Occupancy

The type of business and how the property is used can influence insurance premiums. For example, a restaurant may have higher premiums due to the increased risk of fires, while an office building may have lower premiums. Businesses with hazardous materials or high-risk activities may also face higher premiums.

Tips for Reducing Premiums

- Implementing safety and security measures such as alarms, sprinkler systems, and security cameras can help reduce premiums by lowering the risk of incidents.

- Bundling commercial property insurance with other policies like liability insurance can often lead to discounts from insurers.

- Reviewing the coverage limits and deductibles regularly to ensure they align with the actual value of the property can help prevent overpaying for insurance.

- Working with an experienced insurance agent or broker who can help navigate the options and find the best coverage at competitive rates.

Last Word

In conclusion, Commercial Property Insurance: What It Covers and Why sheds light on the importance of this insurance for businesses. By knowing what is covered, what is not, and how to navigate through potential risks, businesses can ensure a secure future for their properties.

Quick FAQs

What are the common exclusions in commercial property insurance policies?

Common exclusions include natural disasters like floods and earthquakes, wear and tear, and intentional damage by the policyholder.

How can businesses reduce their commercial property insurance premiums?

Businesses can potentially reduce premiums by improving security measures, maintaining a good claims history, and bundling insurance policies for discounts.